Table of Contents

The Surprise Electronic Arts Deal Sending Shockwaves Through the Industry

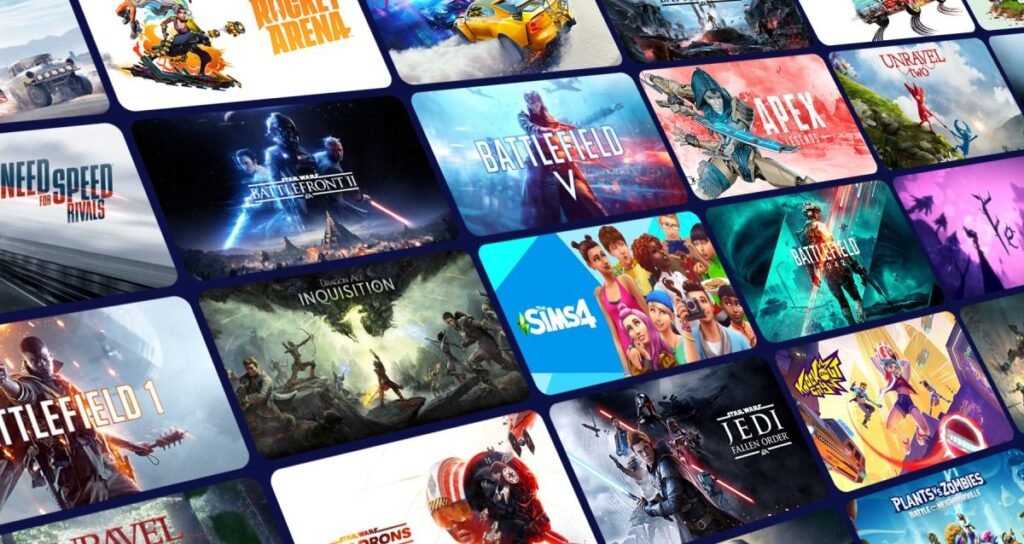

In a move few anticipated, Electronic Arts has agreed to be acquired by a consortium of investment firms led by Saudi Arabia, a decision that has sent ripples through the global games industry. The deal, valued at approximately US$55 billion, comes despite EA’s outwardly strong financial position, buoyed by the success of Battlefield 6, the continued reliability of its sports franchises, and a slate of high-profile projects in development.

What initially appeared to be a smooth path toward acquisition has now drawn the attention of the United States Congress, introducing new uncertainty around the transaction.

Early Assumptions of a Straightforward Approval

When the acquisition was first announced, many analysts expected minimal resistance. While Saudi Arabia’s Public Investment Fund would hold the dominant stake, the inclusion of Affinity Partners, led by Jared Kushner, was widely interpreted as an effort to soften political and regulatory scrutiny within the United States.

That assumption now appears premature, as lawmakers have begun to question the broader implications of the deal beyond its ownership structure.

Lawmakers Call for FTC Investigation

Forty members of the US Congress have formally submitted a letter to the Federal Trade Commission, urging the regulator to conduct a deeper review of the proposed acquisition of Electronic Arts. The request signals growing concern that the transaction may have far-reaching consequences for workers and the domestic games industry.

Unlike many high-profile mergers, the letter does not focus primarily on antitrust or monopoly concerns. Instead, it frames the issue around labour stability and long-term industry health.

Job Losses and Debt Concerns

At the centre of congressional concern is the reported US$20 billion in debt that Electronic Arts would assume under the deal. Lawmakers argue that such a financial burden could incentivise aggressive cost-cutting measures once the acquisition is completed.

These measures could include internal restructuring, studio closures, and layoffs across EA’s global workforce. Given the scale of EA’s operations, any significant downsizing would likely have a substantial impact on employment within the US games sector.

In their letter, members of Congress described the current state of the American video game industry as increasingly fragile. They pointed to ongoing waves of layoffs, studio shutdowns, and shrinking job opportunities as evidence that additional strain could further destabilise the sector.

From their perspective, a more thorough FTC investigation is necessary to ensure that the acquisition does not undermine the long-term competitiveness, sustainability, and talent pipeline of the US games industry.

FTC Response Yet to Be Seen

As of now, the FTC has not publicly responded to the congressional request, and it remains unclear whether the agency will pursue a deeper investigation.

Should the deal proceed without significant regulatory hurdles, the acquisition of Electronic Arts by the Saudi-led consortium, which also includes Affinity Partners and Silver Lake, is currently expected to be finalised in the first quarter of fiscal year 2027. Until then, EA’s future ownership now sits at the intersection of global investment, political oversight, and an industry already under pressure.